Duke Energy Credits For New Furnace

New construction and rentals do not apply.

Duke energy credits for new furnace. That s because a heat pump with a seer seasonal energy efficiency ratio of 14 or higher. We will continue to evaluate practical and viable ways to deliver beneficial programs in the future. So making smart decisions about your home s heating ventilating and air conditioning hvac system can have a big effect on your utility bills and your comfort. What s more you ll continue saving money each month.

Must be an existing home your principal residence. December 31 2020 details. I need these appliances for my home a refrigerator stove and ac. Hidden hidden rebates for indiana homes.

When will the program expire. You could be eligible for a tax credit. The renewable energy tax credit for 2020 is 30 of the cost of the geothermal or other qualifying system. In anticipation of this deadline no program participation will occur after september 30 2020.

Heating ventilating air conditioning hvac as much as half of the energy used in your home goes to heating and cooling. July 12th 2017 at 5 42 pm. Did you make any energy efficient upgrades with new windows a door or a skylight. For ac s the tax credit is worth 300 heat pumps are worth 300 and boilers using gas propane or oil are worth 150.

Advanced main air circulating fan. Home tax credits rebates savings please visit the database of state incentives for renewables efficiency website dsire for the latest state and federal incentives and rebates. What energy tax credits qualify for homeowners. Select a rebate category below to view qualifying equipment and more or view the program fact sheet pdf.

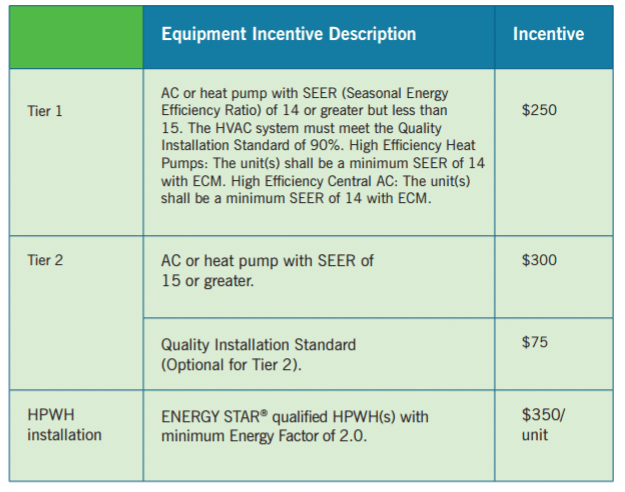

10 of cost up to 500 or a specific amount from 50 300. The renewable energy tax credit program is finished at the. And heating will also qualify for a tax credit. Replace your electric strip heat or older heat pump with a new high efficiency heat pump and you ll be eligible for an incentive credited on your electric bill.

Install a new heat pump to save on your monthly bill and get a rebate from duke energy. The non business energy property tax credits have been retroactively extended from 12 31 2017 through 12 31 2020. Because of changes in ohio law duke energy ohio s current energy efficiency and demand side management programs will end on december 31 2020.